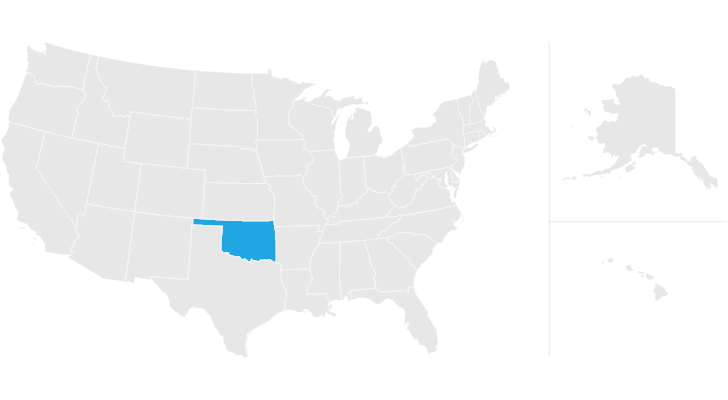

does oklahoma have an estate or inheritance tax

The bill would also raise an estimated 790 billion via tax measures reforms for prescription drug prices and a fee on methane emissions according to the. Spouses are also completely exempt from the inheritance tax regardless of the amount.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

. In some cases however there are still taxes that can be placed on a persons estate. States Without Death Taxes. The Internal Revenue Service IRS.

If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in.

The Tax Foundations recent article entitled Does Your State Have an Estate or Inheritance Tax says that of the six states with inheritance taxes Nebraska has the highest top rate at 18 and Maryland has the lowest top rate at 10. A federal estate tax is in effect as of 2021 but the exemption is significant. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any.

There are both federal estate taxes and state estate taxes. Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. You dont need our consent to transfer stock or a stock waiver certificate if the decedents date of death is on or after January 1 1987.

Very few people now have to pay these taxes. Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax. Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer How To Avoid Inheritance Tax 8 Different Strategies Financebuzz State Estate And Inheritance Taxes Itep How Is Tax Liability Calculated Common Tax Questions Answered States With No Estate Tax Or Inheritance Tax Plan Where You Die Do I Need To Pay Inheritance Taxes Postic Bates P C.

Lets cut right to the chase. In addition to the repeal of the estate tax the Oklahoma inheritance tax has an exemption amount of 5000000. Estate taxes and inheritance taxes.

What is the most you can inherit without paying taxes. 4 The federal government does not impose an inheritance tax. What is the estate tax in Oklahoma.

Estatehelpdordororegongov or Estate Tax unit Business Division. If the date of death was before this date contact us at. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds for example in 2021 the federal estate tax exemption amount is 117 million for an individual receipt of an inheritance does not result in taxable income for federal or state. Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma.

The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. California does not have an inheritance tax estate tax or gift tax.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. Two of the best ways for a person to. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million.

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax. Inheritance tax is only applied if the amount is above each states threshold and is assessed on the amount that exceeds that threshold.

117 million increasing to 1206 million for deaths that occur in 2022.

States You Shouldn T Be Caught Dead In Wsj

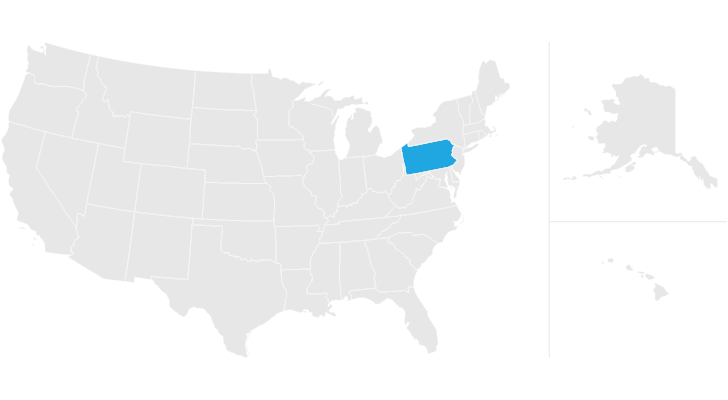

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only Sta Inheritance Tax Estate Tax Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What To Do And Not Do With An Inheritance

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Need To Pay Inheritance Taxes Postic Bates P C

State Death Tax Hikes Loom Where Not To Die In 2021

Calculating Inheritance Tax Laws Com

Inheritance Tax Seven Ways To Shield Your Family S Wealth